For overwhelmed and stressed out parents of 9th, 10th, 11th graders and younger, tossing and turning at night, desperately wondering how they'll afford their kids' college tuition or if they will get in anywhere decent

How to Get Every Last Dime You Deserve for College... and "10X" Odds of Admission to Your Dream School

Blunt and definitely NOT politically correct "College Planning Guru" reveals how to SLASH college costs by 56.2% or more...bargain ruthlessly with overpriced, rip-off colleges for even more...and how your child can optimize his chances of getting into the colleges he deserves to attend

This message is especially for parents who want to avoid letting down their kids by being forced to quietly confess that they didn't do their part, and can't afford to send them to the "Dream College," they worked so hard to get into

Dear Fellow Parent:

Unless you've been living in a cave, you know how ridiculously out of hand college costs have gotten, with no end in sight.

And that was BEFORE Coronavirus, the Test Optional craze and the Supreme Court's decision on affirmative action.

Now the world is upside down, and you may feel like throwing your hands up, out of desperation, wondering, "What can we do now?"

Now is not the time for despair. Quite the opposite, actually. You might be surprised at the new opportunities lying in wait for you, ready for the taking. Let me explain.

My name is Andy Lockwood. I'm the bestselling author of The Pocket Guide to Surviving Your Guidance Counselor's (Lack Of) Advice, How to Pay "Wholesale" for College and four other college planning books, and an expert on college financial aid and admissions, with more than 20 years in the field of college advising.

I've been featured more times than I can count in local, national and international media such as Fox News, The Wall Street Journal, CNBC, CBS and News Nation, to name a few.

I'm not telling you this to show off. Seriously, who cares? I'm humble-bragging because I want you to know that I'm a "real guy," and really hope you pay attention to this short note -- which is about YOU -- not me. I urge you to silence your phone, shut down Facebook and Amazon, and go somewhere quiet where you won't be interrupted for the next 10 minutes...

...Because what I have to say could -- quite literally -- put thousands, if not TENS of thousands of dollars in your pocket, and give your child an almost unfair EDGE in getting accepted to the college of his or her dreams.

I know that sounds hype and too good to be true, but I can prove it.

It's not your fault

Let's not sugar coat things. College costs have been out of hand for 30+ years.

Hundreds of top colleges and universities now get more than $90,000 -- per year -- when you add up tuition, room, board, books and those sneaky, hidden fees.

That's just for one child. If you have two, three or more kiddos headed to college, brace yourself.

And don't even ask about what you GET for paying those prices. Value has nothing to do with the cost of tuition.

So if you're you-know-whatting a brick because you have no idea on god's green earth how you'll possibly afford tuition for your kids, it's not your fault. And you have plenty of company.

The truth about how much YOU have saved for college... compared to OTHERS

I'll be blunt: in pre-pandemic times, 97% of parents hadn't saved enough to cover tuition for their children.

And only 19% of families have a 529 College Savings Plan. Yes, only a fraction of families can pay for college out of their savings.

So, if you don't live in that elite, 3% neighborhood who can cover tuition and room and board out of pocket, don't worry -- you have plenty of company.

And if you CAN simply write a check, why on earth would you overpay, if you don't have to?

Look, no matter which group you fall in, there's absolutely ZERO reason to feel ashamed or to beat yourself up. It won't help things, anyway, because...

The odds are stacked against you.

"Mass affluent" and upper middle class families are under siege, facing:

- Plummeting 529, retirement and regular savings

- Skyrocketing tuition costs

- Exorbitant property and income taxes, rising inflation and a looming recession

- An assault by way of decreasing "real" wages and spending power (by both political parties)

- The Big Business Colleges, who want as much of your cash as they can grab to pay for their administrative bloat and luxury amenities (dorms with flat panel TVs and granite countertops, rock climbing walls, lazy rivers) designed to lure today's teens like moths to a flame

Good news: there's a way out

Thankfully, there's light at the end of the tunnel, and it's NOT an oncoming train. :)

In every crisis, there are opportunities to thrive. GM, GE, IBM and many other powerhouse businesses were formed in depressions, recessions and economic downturns.

Your challenge - and that facing our children - is to THINK like you're in business for yourself, and take advantage of opportunities to hunker down, adapt and emerge stronger than ever.

Here are a few, strange, counter-intuitive and little-known facts about college aid that should give you hope:

- The average tuition discount at a private college is now up to 56.4%, according to the National Association of Collegiate Business Officers.

- The looming recession and inflation hasn't just affected us parents: colleges are under siege too. They're scrambling to hit their enrollment targets. And willing to make deals!

- At most colleges, only 25-30% of families pay "Full Boat" -- the vast majority receive some type of subsidy from the college by way of merit or need-based aid, and the from the government

- Most aid goes to families in the top 25% of earnings, meaning, six-figure and seven-figure income families

BOTTOM LINE: Paying full price is a CHOICE, not an obligation. You need to learn the strategies and legal "loopholes' to beat these colleges at their own sick, twisted game.

That may be all well and good, but I bet I know what you're thinking...

Yeah, great. So how do WE get our hands on the aid we need...and deserve?

Unfortunately, it's not so easy. Colleges are businesses, and they want as much of your money as they can get.

The federal government won't help you -- they're busy collecting $53 Billion plus of student loan interest...

...while they dole out 12.5 Billion and counting to COLLEGES, as a bailout!

Don't bother asking your accountant for financial aid advice, either -- they're struggling to keep up with changes to the IRS tax code, let alone learn a completely NEW set of Department of Education regulations.

99% of CPAs don't know the intricacies, "loopholes" and "landmines" buried in the financial aid regulations.

Can you blame them?

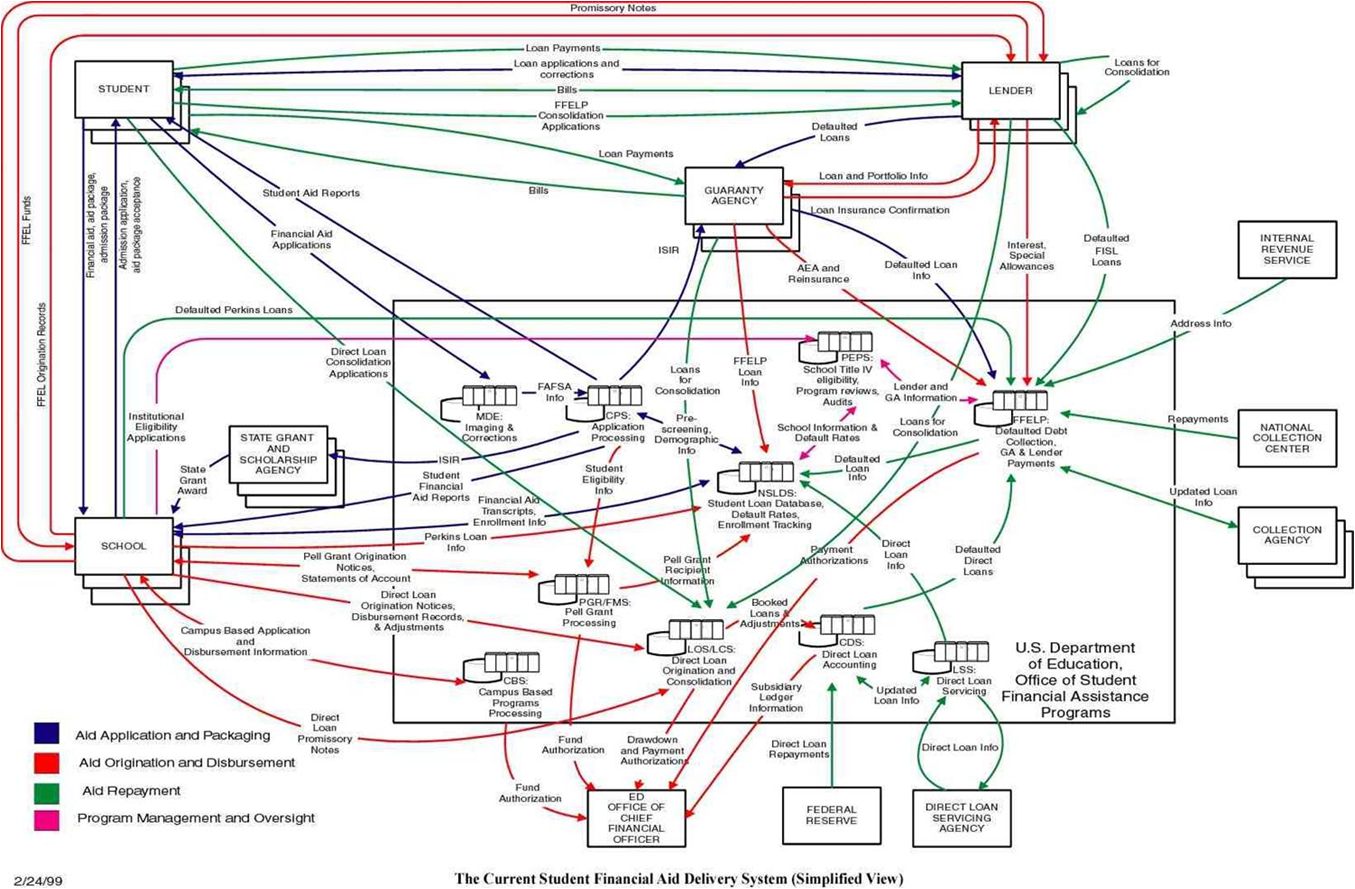

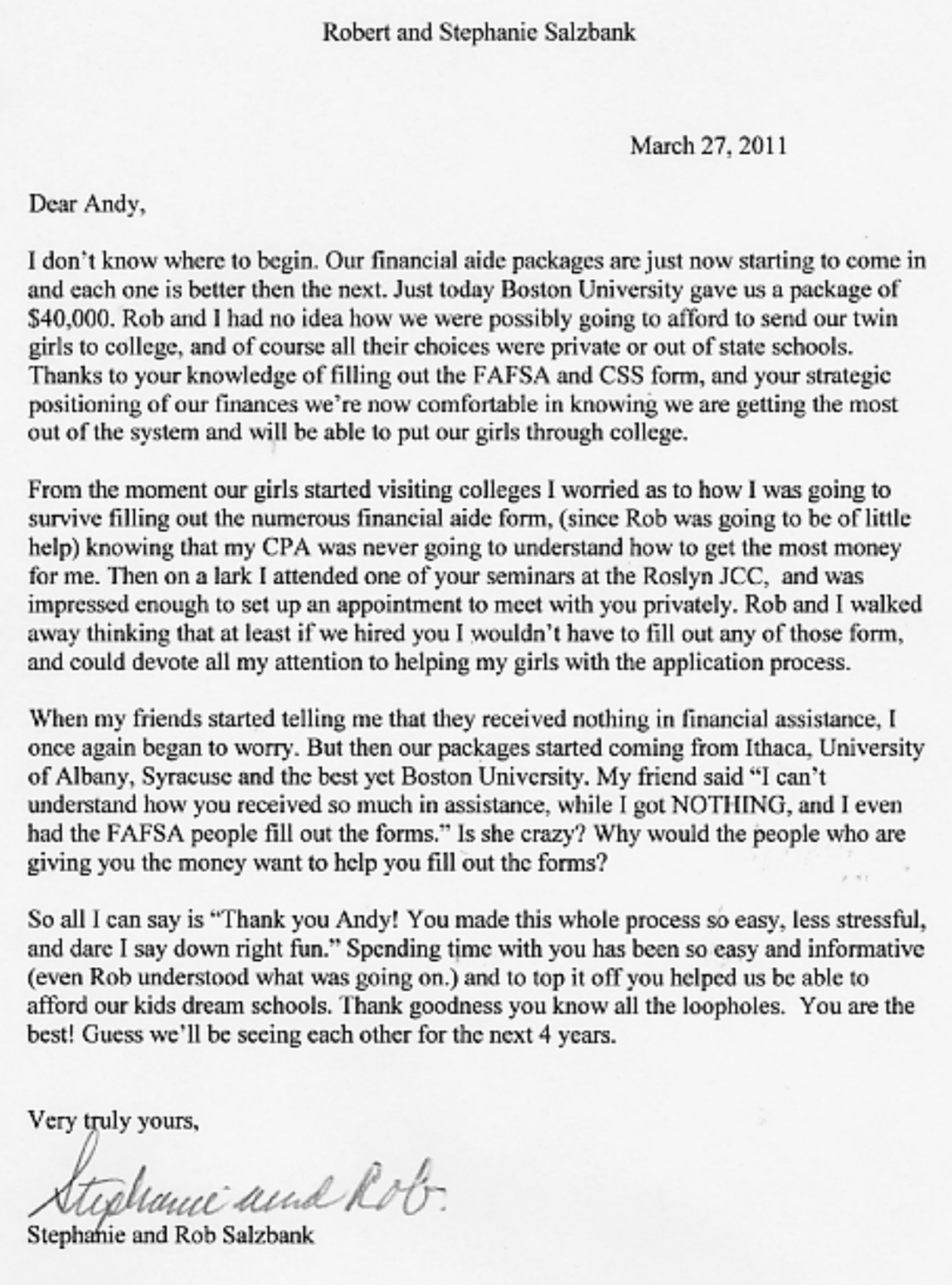

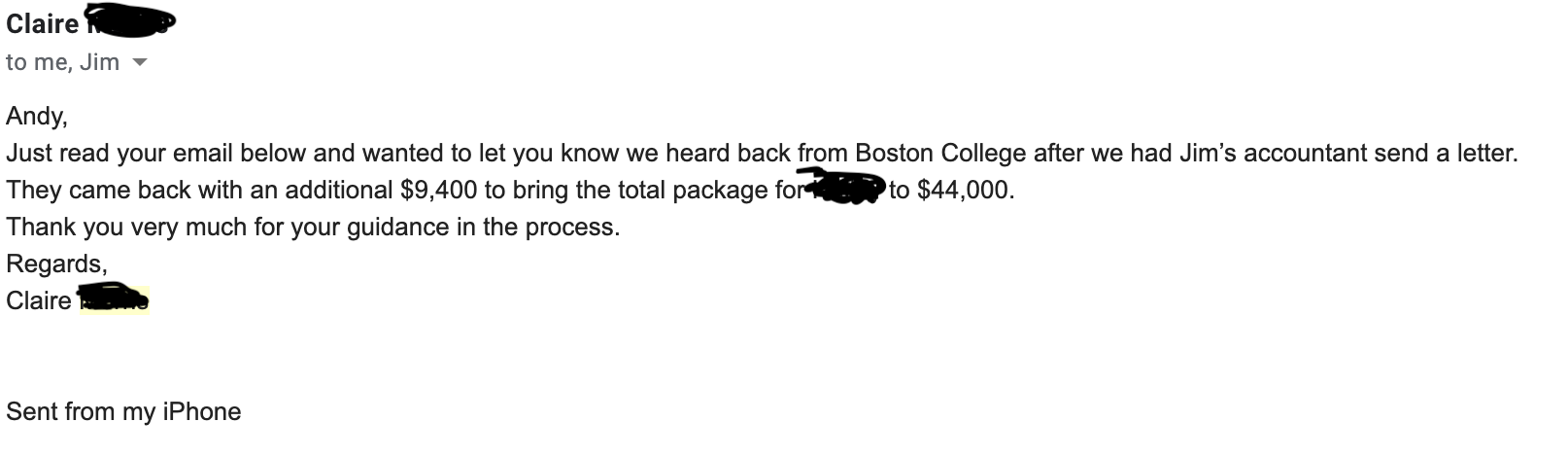

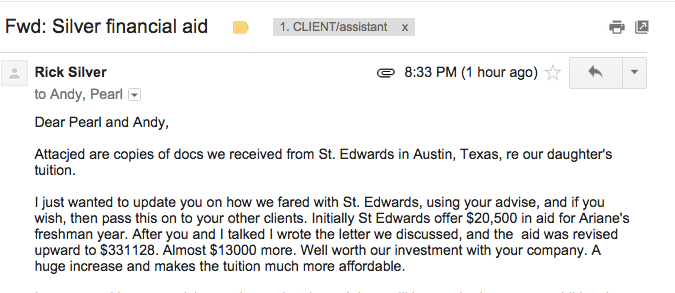

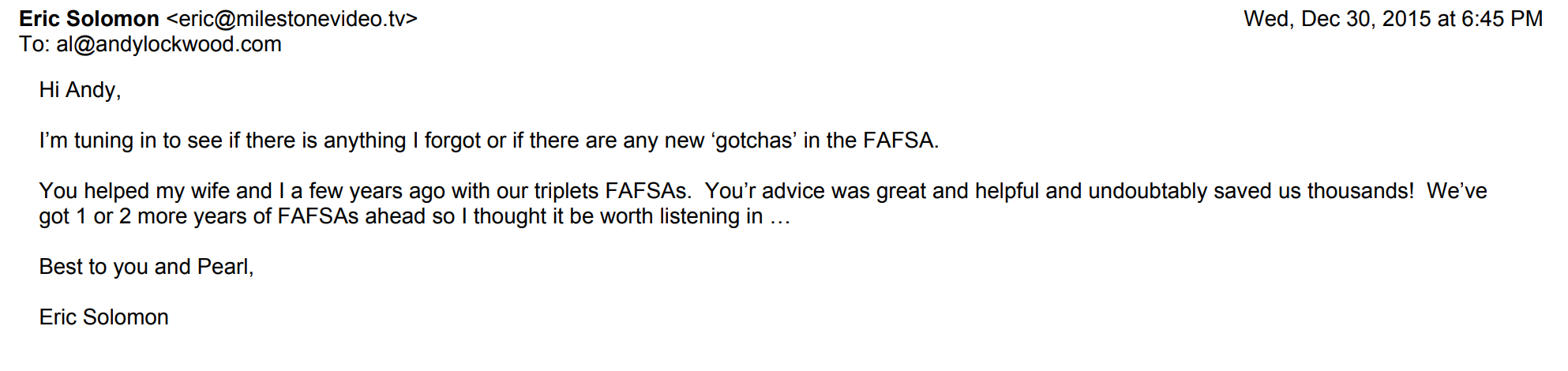

Look at the above chart, the "Simplified" view of the rules and regs behind the FAFSA (Free Application for Federal Student Aid), hands down the less complicated of the two most commonly used financial aid applications.

That's why it's INCREDIBLY EASY to screw up your chances of getting the money you need -- and deserve -- do send your child to the college she worked so hard to get into!

How to Self-Sabotage

Last year, USA today reported that students missed out on a staggering $2.6 Billion in free money for college.

I disagree heartily with that number:

I think it's LOW!

That annual study pertains only to the FAFSA, the federal form. It doesn't contemplate mistakes on the CSS Profile -- an application more than twice as long as the FAFSA -- and about 10 times as complicated!

The CSS Profile is used by approximately 400 colleges to dole out their OWN, endowment funds, separate and apart from FAFSA money.

So the true amount of unclaimed funds could be a multiple of 2.6 Billion, logically speaking.

Which of these mistakes will you make?

I hate to break it to you: it's awfully, incredibly easy to shoot yourself in the foot by committing any number of deadly, critical, money-losing mistakes that result in thousands of dollars -- otherwise EARMARKED for your family -- being left on the table, unclaimed.

Here's an abbreviated "laundry list" of some of the most common self-inflicted errors that do-it-yourselfers make:

- Blowing multiple, confusing deadlines

- Not filing the correct forms

- Mistakenly "oversharing" information that's none of your financial aid officer's business, thus "sabotaging" your chances of aid

- Confusing parent information with student information on the FAFSA

- Failure to understand the key "loopholes" or legal exemptions that can improve your eligibility for more aid

- Not filing because you think you can't qualify

- Not filing, which hurts your ability to get MERIT aid at many colleges

- Business owners: messing up the questions pertaining to valuation of their business

- Business owners: not availing themselves of key "business scholarships" lurking, trapped in their business

- Divorced families: having the "wrong" parent complete the FAFSA

- Negotiation: Failure to proffer the most persuasive arguments to receive an improved offer

- Verification: when a college "audits" your applications after your file, failure to respond to their inquiries in a strategic and effective manner

These were just off the top of my head. I could list another couple dozen without breaking a sweat.

Anyway, you get the point:

Even one, simple mistake you could cost you thousands

Or, without exaggeration, tens of thousands...

...Because if you fill out your FAFSA, CSS Profile, Business Supplement or other forms required by your colleges INCORRECTLY -- or without knowing the proper, legal and ethical STRATEGIES to improve your eligibility at your disposal -- you could MISS OUT on thousands of dollars you otherwise deserved.

We see it each and every year. But you know what's most sad?

These mistakes are easily avoidable.

And, to boot, the stakes are super-high. Your children's future - and YOUR financial future -- are too important to sport a careless, cavalier attitude about financial aid. Because if you "wing it:"

- You could end up saddling your child with six figures of high rate, high fee, CRUSHING debt. (I went through this myself, trust me, it SUCKS rotten eggs)

- You could end up mortgaging your home - or retirement savings - up to your eyeballs.

- Or, perhaps worst of all, you might have to confess, quietly, to your child who "did her part" to get in where she deserves,

"Sorry, I can't swing it. I didn't do MY part."

Here's how to prevent this heartbreak...

All-New Lockwood Inner Circle 3.0 Membership

Times have changed and you should demand more from any investment, including college. That's why I'm bending over backwards to give you the biggest "no-brainer" offer you'll ever see.

When you say "Yes!" to our new Membership, you'll receive:

Monthly Live Workshop/Q&A, “What you should be doing, NOW.”

You will NEVER blow a financial aid or other deadline or miss an opportunity that you’ll regret later on, months or years later.

Pearl and I constantly hear how parents and kids missed out on filing for financial aid, registering for the ACT, SAT, SAT Subject Tests, college tours, and on and on and on.

When you join our Inner Circle, we promise that this won't happen to you. Ever.

The first Monday of each month, you’ll be invited for a live College Coffee Talk session, get REALISTIC, REAL-LIFE, PRACTICAL advice on what specifically you and your college-bound child should be doing.

I say “Real Life” because it’s based on our two-decades plus experience of advising kids to gain admission to the most elite colleges in the country - Harvard, Yale, Princeton, Stanford - community colleges and everything in between!

And, these workshops are interactive, which is a fancy way of saying you can get your personal questions answered each month. Topics include:

- Financial aid strategies, "loopholes" and "landmines"

- Hidden, sneaky financial aid and application deadlines

- Extracurricular activities that help your child stand out

- Which classes should you take, which should you avoid?

- “Best fit” colleges

- College essay writing beyond your English teacher's proofreading

- Visiting colleges

- Choosing majors that lead to satisfying and lucrative careers

- Interview tips

- Scholarships

- Motivating teens

- Study skills

- Test prep strategies

- Recruiting

- "Hidden Scholarships" exclusively for business owners

- Tips for divorced/separated families

- And a LOT more - this list is merely the tip of the iceberg!

This monthly event is the core of the membership. You will look forward to this valuable workshop each month, because, each and every month, you’ll discover what you should be doing NOW, what’s WORKING now!

The point of each workshop is to give you at least ONE thing you can do immediately to give your and your family a leg up on the college admissions and financial aid/scholarships process, based on our case studies and in-the-trenches experience.

It's also designed to ensure that you and your child never miss a deadline or key opportunity to do something to improve odds of college acceptances or winning scholarships and other financial aid.

If you miss the live session, no sweat: all recordings are posted on our private, client-only website for you to review and re-review at your convenience.

PLUS, you will also receive…

The College Planning Edge Newsletter

Each month, we''ll send you via snail mail our client newsletter, The College Planning Edge, which is short, easy-to-read, and chock full of valuable information, in depth, timely features and, occasionally, a joke (OK, more than just occasionally), designed to help you and your family successfully navigate the college admissions and scholarships/financial aid journey, with the least amount of stress and confusion possible!

This hard copy newsletter will not only reinforce the live Q&A call that month, but also serve to remind you about upcoming dates and deadlines to register for the ACT or SAT, file your financial aid forms and other key milestones that, if you blow them, could have severe repercussions.

"College Guru" Secret Tool That Predicts Chances of Admission with 90% Accuracy

SEE PREVIEW VIDEO BELOW

Here’s a dirty little secret guidance counselors will never tell you - they have NO friggin' idea where your kid will get in.

That’s because they use Naviance and other antiquated tools that give a false sense of your true odds of admission.

Over-reliance on your guidance counselor -- and Naviance -- is a giant set up for failure. Getting denied at "target school" after school!

Not your kid. Inner Circle members will receive a one-year subscription to proprietary “College Guru” software, designed by a 30-year veteran of the admissions committee of Princeton University, and back-tested to be 80% accurate.

This privately available software helps our clients avoid “Admissions Armageddon,” by creating strategic and balanced lists.

It compares your child against EVERY other admitted student at each college, world-wide across 20-25 categories, whereas Naviance considers kids from your high school only, and just two factors.

Oh, and our "secret" software also helps predict chances of financial aid and scholarships. That feature alone could pay for your Inner Circle membership many times over.

This tool retails for $497, but is actually worth thousands. However, it’s free when you become a Circle member before the window closes!

It's not available to schools, or to the public, either, fyi.

Hot Seat

Each month, we will choose one applicant to win a 1;1 coaching session, where we will examine your student's grades, standardized test scores, extracurricular activities, leadership, awards, college list, your financial profile and more, absolutely free.

The only other way to get coaching from me is by investing five-figure amounts, so this is a HUGE benefit!

Discounted Financial Aid Forms Preparation

Our members come first. That's our cardinal rule.

One area where this is important is our FAFSA and CSS Profile preparation and consulting service, because we "max out" and shut down each year (earlier and earlier) because of severe capacity constraints.

When you become and Inner Circle member, you'll get first dibs on availability..AND a generous discount off of our prevailing rates to boot!

Discounted Essays and Applications Bootcamps

Another area where we max out by popular demand is for our annual "Incomparable Applicant, Get College Ready Essays and Applications" boot camps, where we work with students on their essays and applications to brainstorm, edit and polish them so that they stand out like a diamond at a coal convention...and maximize their odds of admission to their Dream Schools!

As a member you will get first dibs on admission to these limited space events, a few days before we open them to the public. (We're scheduling two in July, two in August, Sunday mornings from 9am-2pm, live and virtually. Details after you sign up.)

Discounted Test Prep

Yet another benefit for Inner Circle members only is the opportunity to work with our amazingly effective and experienced tutors for the SAT and ACT. We keep classes small, so you'll be entitled not only to first pick of seats when they become available, but also a generous discount off prevailing rates.

If you're interested in 1:1 tutoring, we will also discount you, but the catch is that availability is strictly limited due to demand for our top notch, highly effective tutors.

OK, so what's it take to get "in?"

If you were to hire me, personally, as a college advisor to coach your kid one-on-one, you'd be looking at $30,000 if we started in 11th grade. (Less if you worked with one of my associate college advisors.)

Even though that fee is unconscionable for many, clients pay it unblinkingly because of the VALUE of our advice.

But we know that amount is out of reach for most families, so we wanted to offer something more affordable. A way to get access to the same advice, and to me (Andy) and Pearl, but limited to small group settings. That's how we came up with the Inner Circle.

Real World Value: $497/month

Regular Price: 297/month

If you enroll by deadline: you will automatically be approved for a generous "Early Action Scholarship"

Only 97/month

Our best clients are the ones who take prompt, decisive action. That's why we're making it worth your while to sign up now, before the countdown clock expires! (You can cancel any time, there are no termination or other weird fees.)

"Early Action," Limited Bonuses

If you're still on the fence, here's a "Godfather Offer" you'd be plain silly to refuse

To further sweeten this "college stimulus package" and make it even more of a drop-dead, no-brainer, you'll get the following Early Action bonuses, but with one "catch."

They're yours only if you're one of the first Lucky 13 to enroll:

BONUS 1: One hour session and written Competitive Analysis and Positioning Report with Andy Lockwood to review:

- student GPA

- student course load

- student test scores

- student's club participation

- student leadership and character

- student out-of-school activities

- student's college list (preliminary)

- parent financial profile

- all of your questions!

The CAP Report and session will ensure that you're on the right path and will get the most out of your Inner Circle membership. Andy's billable rate is $1,188 per hour -- people have paid that rate, not hype -- so this is extremely valuable.

One suggestion alone from this hour could pay off, many, many times over - we hear this from our clients all the time.

BONUS 2. Access to our flagship product, Instant College Funding 2.0 This product sells for as much as $997 (also not marketing hype: we've actually sold it for that price) because it walks you through the EXACT loopholes and landmines lurking on the FAFSA and CSS Profile, including a deep dive into the *New FAFSA*.

Inside Instant College Funding you will discover:

- Which savings "penalizes" you more than others

- Which savings are entirely "exempt"

- 4.5 legal and ethical "loopholes" that could save you thousands

- The truth about the 529

- How to negotiate with a college

- How to get more merit aid if you can't qualify for need-based aid

One tip or strategy from this course could - quite literally - save you thousands or even tens of thousands of dollars. This bonus alone could pay for your membership many times over.

But your incentives to move ahead with the Inner Circle membership isn't limited to financial aid and merit aid strategies.

If you say "yes" today, your membership will also include valuable INSIDER information on how to MULTIPLY your odds of admission to your "Dream Colleges!

BONUS 3. The Incomparable Applicant Master Class. This on-demand training is no longer available, but we used to offer it for $297. We took it out of the vault and dusted it off for you, as a special incentive to jump into the Inner Circle membership.

It's absolutely free but extremely valuable and unique, containing the following strategies and actual, bona fide "insider" information:

- A "Master Class' on the college essay, where Andy interviewed two admissions officers from U Chicago (admit rate; approximately 6%) on what they want to see in an essay, and what they hope your child will AVOID writing about

- Non-public interview with Don Betterton, 30-year veteran of Princeton University's admissions committee and head of financial aid, on how the college scandal (remember that?) changed college admissions.

- Advice re: supplemental essays

- Advice re: college touring

- Sample college essays that worked (our clients got in to their top choice colleges, and received scholarships worth tens of thousands of dollars)

- More!

Total value of "Early Action" Bonuses: $2,482

I know I just dropped a huge and perhaps overwhelming Value Bomb on you, but this information is special and unique, and I wanted to make this offer the greatest offer for a product you'll ever see in your lifetime. (Am I being too subtle?)

You won't get this insider advice anywhere else. These goodies are yours if you're one of the first 13 to enroll.

Who Should Enroll in Our Program?

There are several reasons to join the Lockwood Inner Circle. Here are some of the most common:

- To learn "insider' strategies to get more money from the overpriced, rip-off colleges

- To discover the "secret" strategies to optimize your college applications and essays so that your admissions officers roll out the red carpet for you and practically beg you to come

- To NEVER miss a deadline during this overwhelming, stressful process

- To get access to coaching for a fraction of the five-figure investment our 1:1 clients make

- To learn how to qualify for MERIT aid at many colleges

Final Thoughts

The world is upside down. Things are unclear.

But when this pandemic is over -- and it WILL be over -- it will be back to business.

For those families who realize this NOW, and TAKE ACTION now, in preparation, they'll be in the driver's seat and get the best results.

But if you're one of those families who sits motionless, paralyzed with indecision, you're setting yourself up for a rude awakening when the dust settles.

We were all blindsided once by Coronavirus once, don't allow yourself to fall behind, again.

Even if your children don't realize it, they need you now, more than ever.

THIS is the time to finish what you started, to make sure that they get every advantage and opportunity to go to the BEST college for them, at a price that's right for the WHOLE FAMILY.

We're here to help you make that happen.

When you enroll, you'll feel great, immediately, because you'll have gotten your children the best help you're capable of.

You'll put true experts in your corner, who will be right there by your side, taking you by the hand and leading you from a dark cave, fraught with peril, into the light.

Who should NOT enroll? A word about guarantees, and personal responsibility

If we learned nothing from the Felicity, Lori et al Varsity Blues scandal, if anyone promises you a "guaranteed" result, you should run, not walk, away.

Because barring any bribing, photoshopping or other shenanigans, there's absolutely NO WAY anyone, present company included, could guarantee results.

I cannot control your child's efforts or motivation.

I cannot control your compliance with the advice in this program, Instant College Funding and other bonuses.

I can't control your child's grades.

Nor can I control his standardized test scores.

I have no control over any of your colleges' budgets.

I have no idea who ELSE is applying to your child's colleges this year.

That's why every reputable trade group of college advisors and colleges considers guarantees to be completely UNETHICAL.

I realize that we're both adults, and you must know this, but I felt the need to put it in writing, because I always err on the side of full disclosure, whenever in doubt.

Your and your child's success or failure is almost exclusively based on your efforts and willingness to take responsibility for your results.

Do NOT join us if you see things a different way.

But if you agree, and you want to be part of a community of parents who tend to see things the same way as you, come on in!

Real World Value: $497/month

Regular Price: 297/month

If you enroll by deadline: you will be approved for a generous "Early Action Scholarship""

Only 97/month

Sneak Preview Video of our Software that Kicks Naviance's Boot-tay

Questions?

If you have any questions about our process, which program you need or anything else, email "[email protected]" or call 516-882-5464 and we'll get back to you as soon as we can.